The Foundations of Investing: Part IV, Everything Compounds

Investment ManagementJul 06, 2023

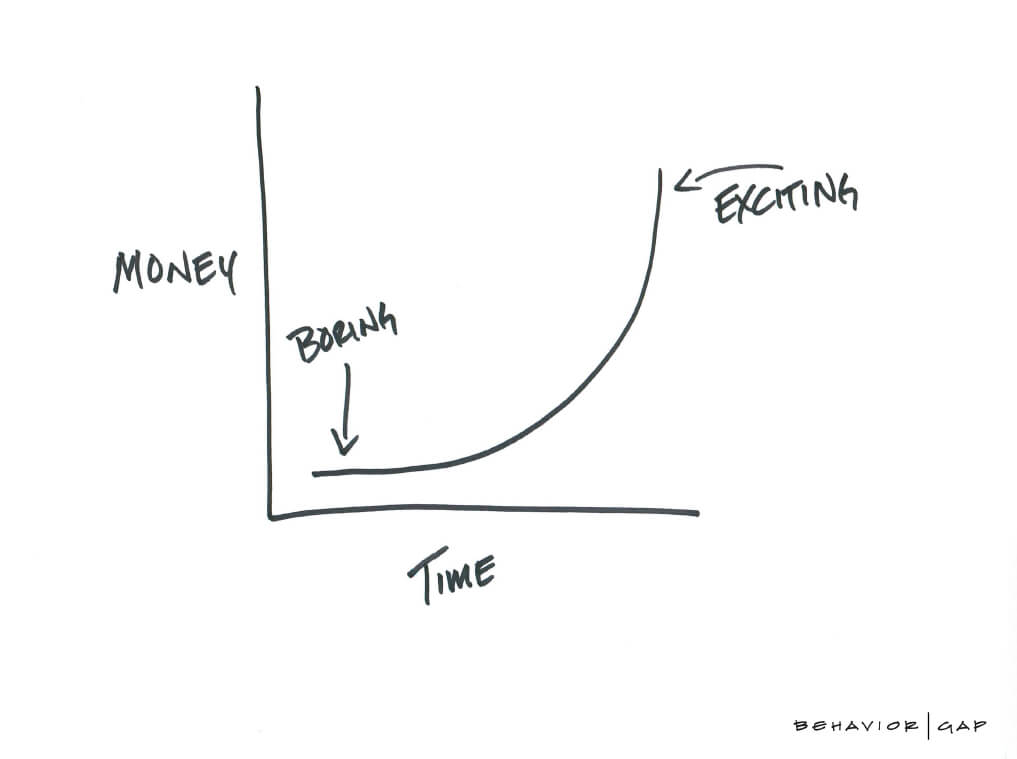

There are thousands of articles, research reports, and books explaining the importance of compounding when it comes to investing. We’ve certainly written our fair share. If the topic sounds incredibly boring to you, just think of compounding as the ability for our money to earn money for us, and when we reinvest it, that money earns money for us, and on and on. Maybe you’ve seen quippy quotes extolling the virtues of compound interest from Albert Einstein or Warren Buffet. The point is this: the reason for the constant focus on this concept is simple- it is that important. While much of what is written about in the investing world can be misinterpreted, overblown, and exaggerated, we believe the concept of compounding is one of the few things that is under appreciated. The human brain thinks in a linear way, so the exponential growth provided by compounding is not grasped easily. It is for this reason we believe understanding that “everything compounds” must be a foundational principle for any investor. Here are two visuals that help explain why:

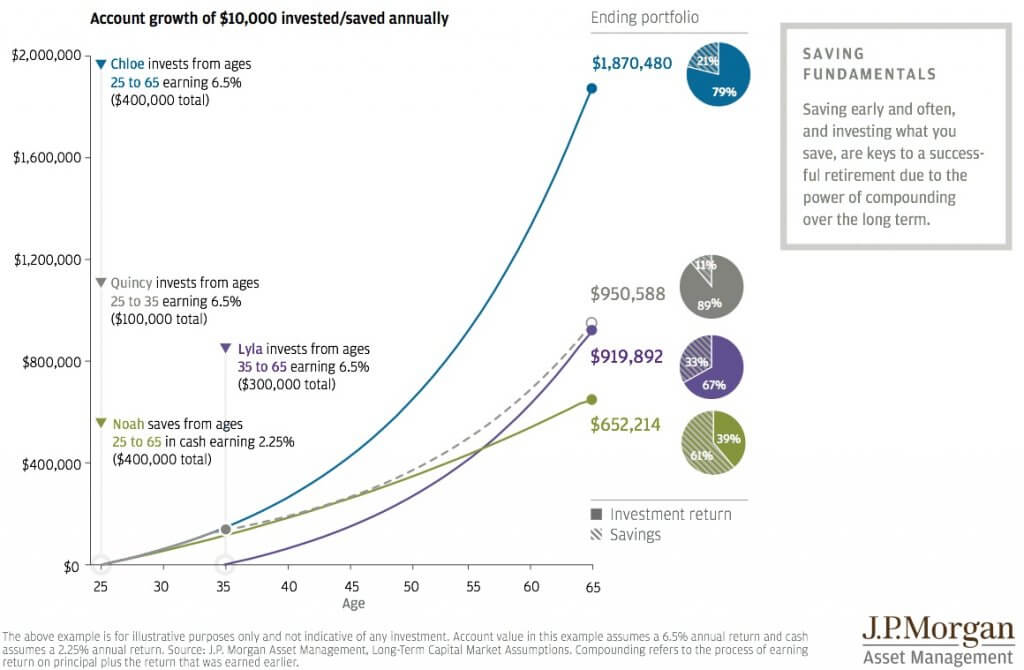

This first chart from J.P. Morgan shows four different people with very different approaches and thus, very different outcomes. Chloe saves and invests $10,000 annually from age 25 to 65 and gets a 6.5% return. Her portfolio has grown to almost $2 million by the time she reaches retirement age! On the other end of the spectrum, there is Noah who also focuses on saving, but doesn’t invest and keeps his money in cash. This same amount saved only turns into a little over $650,000.

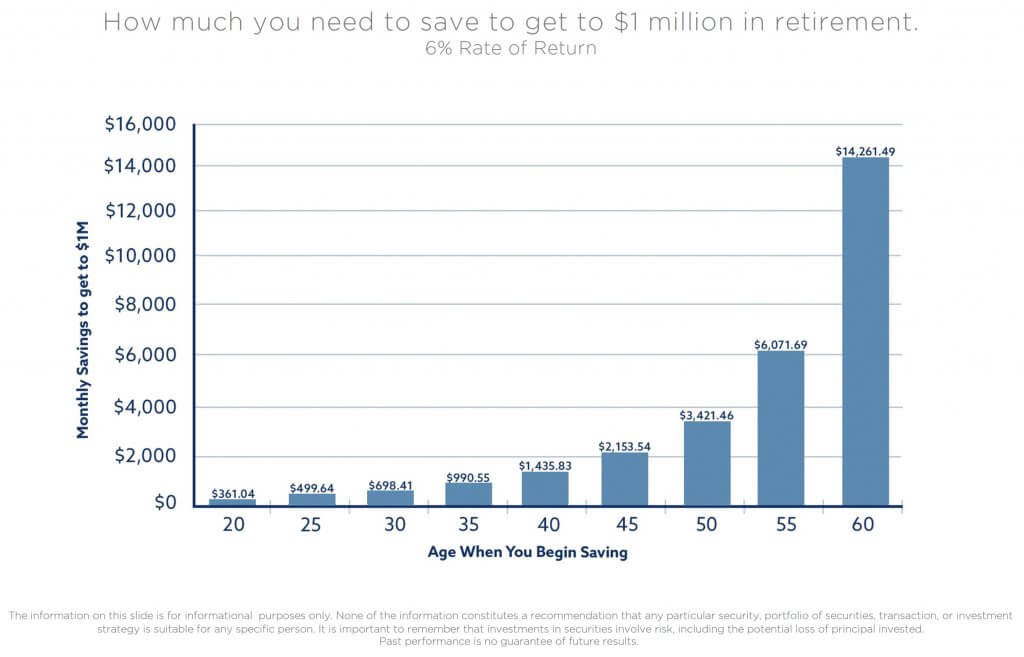

This second chart is a bit simpler. It shows how much you’d have to save each month to get to $1,000,000 at age 65 based on when you started investing, assuming you got a 6% average return. While a 25-year-old can become a millionaire simply by putting less than $500 a month aside and getting a decent return, someone who waits until later in life is going to have a much harder time accomplishing that same goal.

These charts are different, but they help quantify the two same points in dollar terms:

- Saving is important, but it isn’t enough to build a retirement nest egg. We must also take advantage of the long-term compounding effects provided to us over time through investing our savings

2. We don’t need to be perfect for decades to have good outcomes, we just need to the best we can today and keep doing that repeatedly over time and we will be exponentially better off in the long run. Rather than putting too much pressure on yourself to be perfect, its about finding the right balance that works for today and tweaking it as you go

Now, here is the part that often gets forgotten when it comes to compounding: it is always happening; the only question is whether its working for you or against you. What determines that is two things: our actions (or inactions) and the amount of time that passes. The longer we are disciplined or doing the best we can, the better the outcome. The longer we are indecisive or fearful, the harder everything will get later on. When it comes to our money and compounding, the math works the same way whether we are talking about an investment account helping you build and preserve wealth, or debt that is accruing, preventing you from doing so.

The best investors in the world all share two traits, regardless of their investment approach: temperament and discipline. That is because it is our repeated behaviors- regardless of what they are- will have the biggest impact on our outcomes. If we choose to panic when markets sell-off, wait for “the perfect time”, or ignore our finances all together these choices will compound. While we may not notice the impact of these choices in the short-term, they will dictate how things turn out in the long-term.

What is funny about compounding, is that is not just a force that applies to investing. In fact, it touches every single part of our lives. James Clear wrote in his book Atomic Habits: “Time magnifies the margin between success and failure. It will multiply whatever you feed it. Good habits make time your ally. Bad habits make time your enemy.” Let’s use diet as an example. Shane Parrish describes this concept: “When we watch people make small choices, like order a salad at lunch instead of a burger, the difference of a few hundred calories doesn’t seem to matter much. In the moment that’s true. These small decisions don’t matter all that much. However, as days turn to weeks and weeks to months and months to years those tiny repeatable choices compound.” This applies to anything in life that requires an investment of money, time, or energy.

The farther you zoom out, the clearer it becomes just how much small repeatable actions have outsized impacts on our lives. Ravi Nagarajan said it well: “one of the ironies of life is that many bad habits provide immediate rewards while negative consequences are concealed for a long period of time. Good habits often seem to offer the opposite scenario: immediate discomfort that is only rewarded in the long run.” It doesn’t matter if we are talking about our finances, physical health, mental health, intellect, learning new skills, or relationships. The more we put in (or don’t) to the things that matter most over a long period of time, the more noticeable the impact will be down the road. Invest accordingly. Everything compounds.

Citations:

Guide To Retirement, J.P. Morgan, 2023

Atomic Habits, James Clear, 2018

The Rational Walk, Atomic Habits, Ravi Nagarajan, February 8 2021