To Roth or Not To Roth?

Financial PlanningJul 26, 2023

Should I move it into a Roth? That question is posed to us quite often. Roth IRA’s have gained in popularity over the last 10 to 15 years mainly because of legislation that made them more accessible to higher income families. While the concept of tax-free retirement income is very attractive, it is important to understand the tradeoffs associated with making Roth contributions or converting IRA funds to Roth. In many cases, the people asking us the question about moving money to a Roth changed their minds after we explained the tax implications.

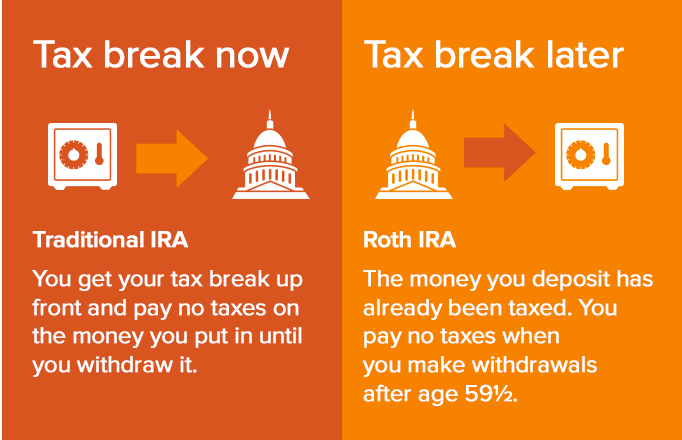

Let’s start by reviewing the difference between a Roth IRA (or 401k) and a Traditional IRA (or 401k). In the Traditional way, you get a tax deduction for money you put in now and pay tax on any money that comes out of the account when you begin accessing it. In a Roth, you don’t get a tax deduction to contribute, but you don’t pay taxes when you withdraw it as long as you had a Roth for 5 years or more and are over 59 ½ years of age.

Thanks to some legislation passed in 2001, most Americans have to decide whether to make Traditional or Roth contributions to their 401(k) plans. In this situation, we would consider your age, current cash flow and your tax situation. There is a cost associated with utilizing the Roth contribution option because you miss out on the tax break today. With that in mind, if you are looking to get as much as possible in the account with the lowest impact on your cash flow, then you are probably better off with the Traditional. If you like the idea of tax-free growth, but are in a high tax bracket, you should take the time to evaluate what is best for you.

In 2010, another major barrier to entry was eliminated when the income limitation was removed for Roth Conversions. In the years leading up to it, some were calling it the financial planning opportunity of a lifetime. The year 2010 came and went, the limitations were lifted, and not nearly as many people took advantage of it as predicted. The reality is that converting money from an IRA to a Roth IRA has a cost associated with it. If you convert your $100,000 IRA to a Roth IRA, you have to come up with the money to pay income tax on the $100,000. That turned a lot of people off and they decided to keep the money in the IRA.

Some people will take advantage of a loophole in the tax code called a “backdoor” Roth. However, you need to be very careful with this. The way it works is you can contribute to a “non-deductible” IRA and then immediately convert it to a Roth. This is only necessary if you are over the income limit to contribute to a Roth. The way you can run into issues with this is if you have other IRA assets. The IRS counts the other IRA towards your conversion, and you end up owing taxes on a portion of the conversion. If you have a sizable balance in your IRA, then most of your conversion will be taxable, thus eliminating the loophole.

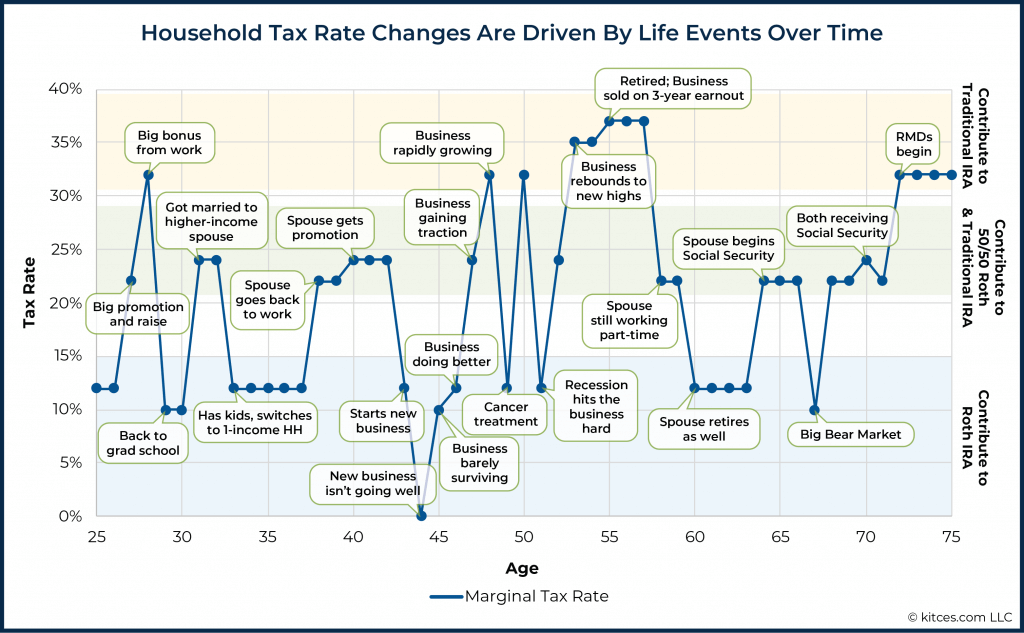

In reverting back to the original question, is a Roth right for you? Of course, you know that answer is going to be that it depends. The chart below that was shared with us by one of our clients depicts the debate perfectly. Our rule of thumb is that the younger you are, the more it makes sense. If you can take advantage of compound interest for an extended period of time tax free, then it is worth some strong consideration. However, the chart offers some arguments to that thought process for the higher earning years. It also reminds us that you don’t have to go all in on Roth or Traditional.

One other situation we’ve encountered that isn’t on the chart pertains to people who are close to or in retirement. Those who have been fortunate enough to build up a lot of wealth and are thinking about the next generation can contribute to a Roth or convert some IRA money to Roth and earmark it for their children or grandchildren. It can be an effective way to continue the tax benefits beyond your lifetime.

The Roth is an excellent way to manage taxes for both retirement planning and estate planning. If you aren’t sure if it works for you, take the time to evaluate it with a professional. Making an informed decision can save you and your family substantial tax money in the long run.

Citations: kitces.com